Understanding how to calculate MAGI (Modified Adjusted Gross Income) for premium subsidies or eligibility in Medicaid is an important step in your health insurance search.

In Colorado, adults with household incomes up to 138% of poverty (133% plus the built-in 5% income disregard) are eligible for Medicaid (Health First Colorado), and kids are eligible for CHP+ with household income up to 265% of poverty.

Most adult applicants with household income above 138% of poverty will find that they qualify for subsidies to help cover the cost of a private plan purchased through the exchange (prior to 2021, there was an upper income limit for subsidy eligibility, set at 400% of poverty; that has been eliminated at least through 2025).

How to claim the ACA tax credit

Note that the prior year’s poverty level numbers are used to determine subsidy eligibility, while current numbers are used to determine Medicaid/CHP+ eligibility (in both cases, the amounts are compared with your projected household income for the year the coverage will be in effect).

Here are charts that show percentages of the poverty level in terms of dollar income amounts:

- For 2022 (used to determine subsidy eligibility for 2023 coverage)

- For 2023 (used to determine subsidy eligibility for 2024 coverage)

Those subsidies are significant: Three-quarters of the people who enrolled in coverage through Connect for Health Colorado (the state-run exchange) in 2023 were eligible for premium subsidies, which reduced their average net premiums to just $143/month.

How to calculate MAGI “household income”

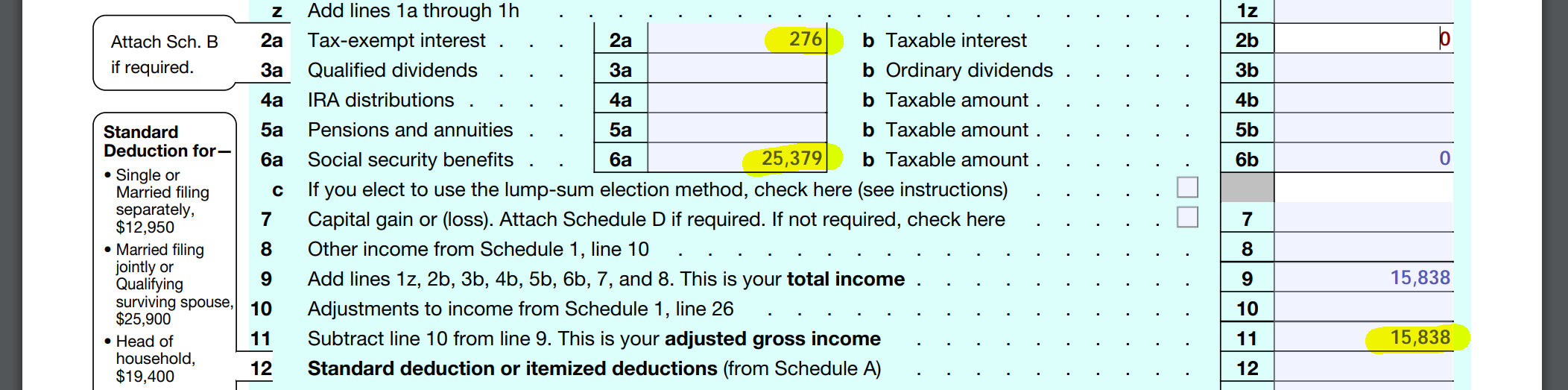

This 1040 shows a Modified Adjusted Gross Income (MAGI) for this family of $41,439, because they needed to add tax-exempt interest and non-taxable Social Security benefits to their AGI.

Household income is usually referred to as MAGI (modified adjusted gross income), but MAGI is calculated differently in different situations. For the ACA, there’s a specific calculation for subsidy eligibility determination.

This brief from UC Berkeley is the most concise version I’ve seen for how to calculate MAGI for determining subsidy eligibility. But if you want the longer version, there’s this Federal Register page from 2012, which also references IRS Section 911. Together, they tell the same story as the UC Berkeley document.

To calculate your MAGI for subsidy eligibility, you start with you AGI (line 11 on the 1040). Then there are three things that you have to add to your AGI, if they apply to you:

- Non-taxable Social Security income (this is line 6a minus line 6b on the 1040).

- Tax-exempt interest – for example, if you have tax-exempt municipal bond income (this is line 2a on the 1040).

- Foreign earned income, and housing expenses if you live abroad (form 2555).

If you don’t have any of these three sources of income, your MAGI is the same as the AGI listed on your 1040. But if you do have any of these sources of income, you have to add them to your AGI to get your MAGI. For example, if your AGI is listed on your tax return as $21,000, but you also have a non-taxable Social Security income of $20,000, your MAGI for determining subsidy eligibility is $41,000.

The most common one is non-taxable Social Security benefits. Even though those benefits are not taxed when you file your return, you need to make sure you add them to your AGI when you’re calculating your household income to see if you qualify for subsidies. Not doing so will result in an overpayment of subsidies, and that gets reconciled when you file your taxes the following spring. If your subsidy is overpaid, you’ll have to pay back all or part of it (depending on your income) when you file, and that’s not a pleasant surprise.

(Remember that income is projected a year in advance, so you won’t have the data from the tax return until after the year is over. This is why subsidy amounts get reconciled with the IRS when you file your taxes after the year is over.)

Open enrollment in Colorado begins November 1st and ends January 15, but the deadline to get coverage effective on January 1 is December 15, unless you have a qualifying event. So if you haven’t done so already, it’s time to start gathering the documentation you need for household income verification, provider network searches, drug formularies, etc. and get yourself enrolled or shop around for a new plan. As always, we’re happy to help you compare options both on and off the exchange.